25+ 60000 mortgage calculator

This calculator should be used as an estimate only. The rate on the 30-year fixed mortgage slipped to 499 from 53 the week prior according to Freddie Mac.

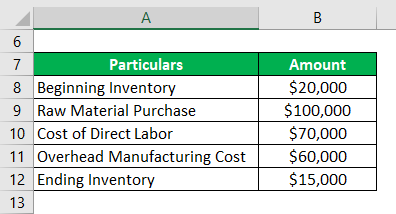

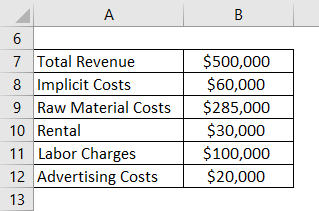

Cost Of Sales Formula Calculator Examples With Excel Template

Discover the power of accelerated payments with the Velocity Banking Calculator.

. Mortgage Indemnity Insurance Republic Banks normal lending criterion is 80 of the lower of cost or market value however up to 90 financing is also available. A good monthly home mortgage calculator tells individuals not only if they can afford a selected home but what kind of factors might influence future payments. This calculator will help you to quickly convert a wage stated in one periodic term hourly weekly etc into its equivalent stated in all other common periodic terms.

And then multiply that number by 8 to get your pre-tax biweekly income. Learn how to use our mortgage calculator to determine your monthly mortgage payments including PMI taxes insurance down payment interest rate and more. Using our mortgage rate calculator with PMI taxes and insurance.

Your mortgage will then amount to. 10 Year Fixed Rate Mortgage Calculator. The lower rate and shorter term results in cheaper interest charges.

You would make approximately 300 payments averaging about over the course of 25 years. For additional information about or to do calculations involving mortgages or auto loans please visit the Mortgage Calculator or Auto Loan Calculator. Initial rate 351.

But note that 15-year fixed mortgage rates are lower by 025 to 1 than 30-year fixed-rate loans. 55 25 60000 30000 1575370. Current Net Worth is your total current net worth including stocks bonds cash and retirement accounts.

This mortgage calculator gives a detailed breakdown of up to two mortgages and calculates payment schedules over your full amortization. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. The total cost of a 120000 mortgage over 25 years is 212007.

So if youre purchasing a 300000 home that means youll want to make a down payment of 60000 before closing on the loan. One point equals one percent of the loan amount. For example 2 points on a 100000 mortgage equals 2000.

351 Fixed to 31032028 From HSBC. This would not include real estate equity unless you later plan to sell your real estate in. Fannie Mae chief economist Doug Duncan believes the 30-year fixed rate will be 28 through 2021 and reach 29 in 2022.

57 27 60000 30000 1773396. The TD Mortgage Payment Calculator can help you better understand what your payments may look like when you borrow to buy a home. Current Redmond mortgage rates are published beneath this calculator.

Factors that impact affordability. 2021 2022 Mortgage Rate Housing Market Predictions Mortgage Rates. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1078 monthly payment.

No quick relief in rent increases economist explains. The whole of market MSE mortgage best buys tool allows you to find the cheapest rates fees for fixed variable and more mortgages. Mortgage Calculator For Over 60s - Compare Mortgage Rates - Calculate Fixed Variable Deals - FREE Mortgage Calculator - Latest UK Lender Options For Moving Home Or Remortgaging.

While your personal savings goals or spending habits can impact your. The results are based on the information you put into the calculator. Assuming you have a 20 down payment 60000 your total mortgage on a 300000 home would be 240000.

Use the chunking calculator to determine the years of payments youll save. This insurance is available up to a value of 100000. Mortgage Indemnity Insurance is insurance required when the loan amount required is in excess of the 80.

Sometimes referred to as discount points or mortgage points. Your down payment is. Money paid to the lender usually at mortgage closing in order to lower the interest rate.

PMI is automatically removed once a borrowers loan-to-value ratio reaches 78. If you opt for biweekly accelerated. The calculator does not consider a number of factors which influence Lenders Mortgage Insurance such as a borrowers financial situation and assets and the security property type.

If you work 2000 hours a year and make 25 per hour then you would add 4 zeros from the annual salary multiply the result by 2 to get 50000 per year. Use our calculator to work out your monthly repayments on a 300k mortgage. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment.

When it comes to calculating affordability your income debts and down payment are primary factors. With a few key details the tool instantly provides you with an estimated monthly payment amount. Our mortgage repayment calculator will give you an idea how much monthly payments on a 300k mortgage will be.

Because the VA guarantees a quarter of the loan amount the maximum entitlement in this county is currently 161800. Especially with rates even the most minute change can have a big impact on your estimated mortgage payments. 56 26 60000 30000 1672323.

Suppose you bought a 300000 house and offered a 20 down payment worth 60000. You may also enter extra lump sum and pre-payment amounts. More information on this mortgage.

So you no longer have to pay a mortgage. Repayments on a 60000 mortgages. Plus full QA incl full info on stamp duty holiday up.

If your effective tax rate is around 25 then that would be like subtracting 2 from the 8 so youd. This calculator will help you to quickly convert a wage stated in one periodic term hourly weekly etc into its equivalent stated in all other common periodic terms. The repayment period must be a minimum of 1 year and a maximum of 30 years.

The Mortgage Bankers Asociations chief economist Mike Fratantoni believes the 30-year fixed rate will reach 33 in 2021 and 36 in 2022. 60000 one-time payment Monthly. Making Additional Home Loan Payments.

Fixed Monthly Payment Amount This method helps determine the time required to pay off a loan and is often used to find how fast the debt on a credit card can be repaid. Its usually rolled into mortgage payments which costs around 025 to 2 of the loan annually. Lets assume youre currently using 60000 of your VA loan entitlement and want to purchase a new home in a standard cost county 647200 loan limit.

Results are based on a 30 year loan term.

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

4 Strategies To Help You Pay Off Your Mortgage Sooner Think Realty A Real Estate Of Mind

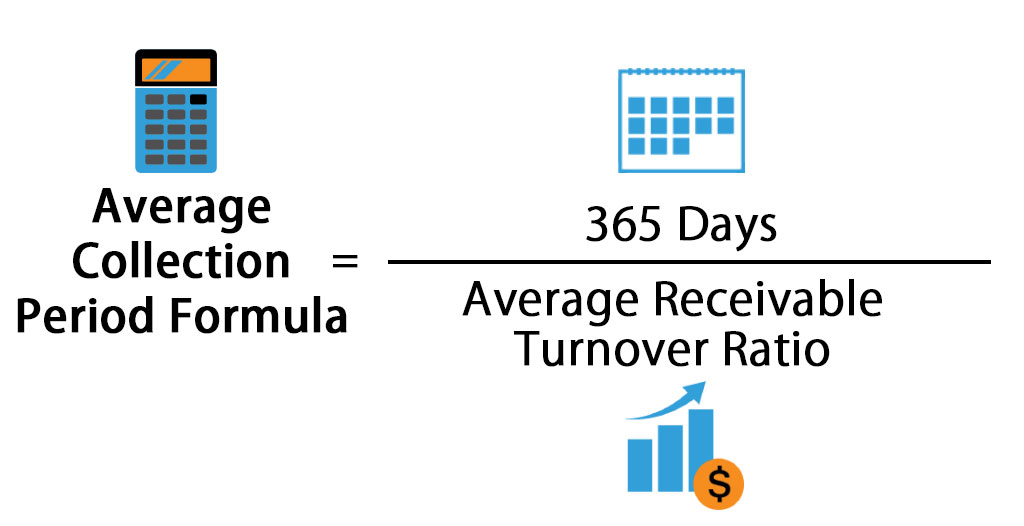

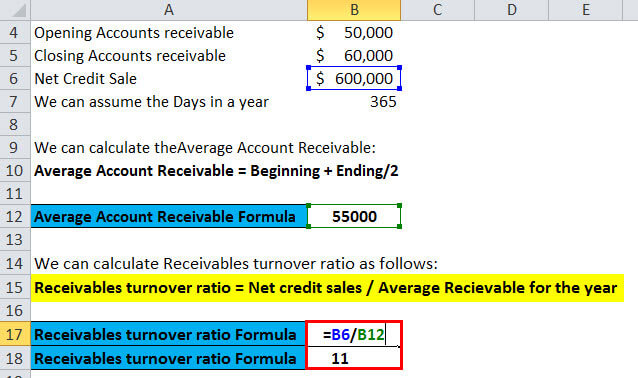

Average Collection Period Formula Calculator Excel Template

Residential Refinance Originations Increase Q4 Of 2016 Think Realty A Real Estate Of Mind

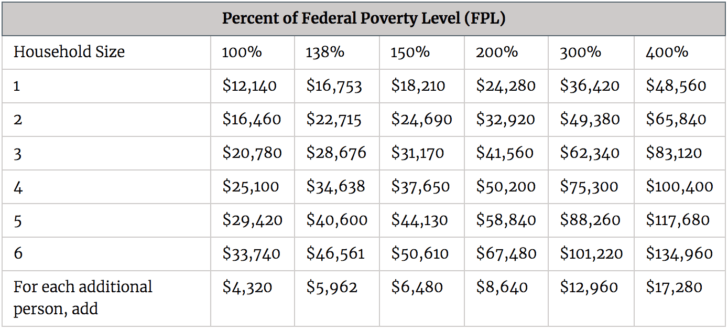

How Much Should I Pay For Healthcare Healthcare Affordability Ratio

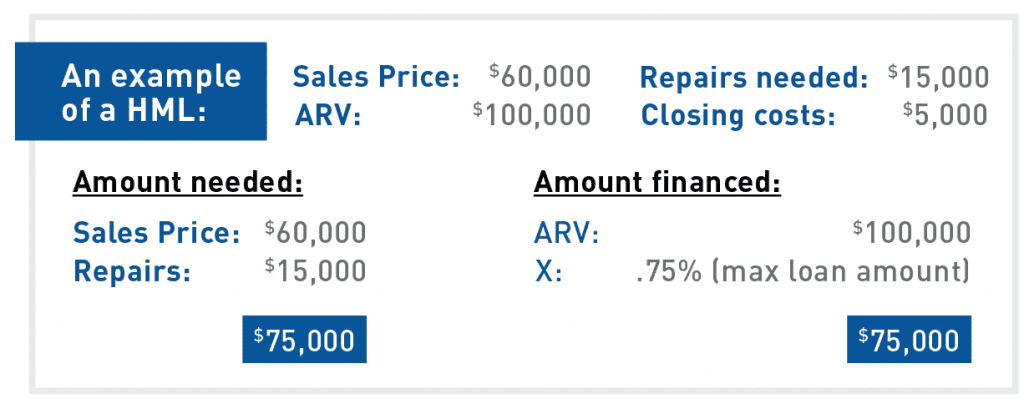

Hard Money Loans Think Realty A Real Estate Of Mind

How Much Should I Pay For Healthcare Healthcare Affordability Ratio

How To Calculate Irr Internal Rate Of Return In Excel 9 Easy Ways In 2022 Excel Cash Flow Calculator

How Much Should I Pay For Healthcare Healthcare Affordability Ratio

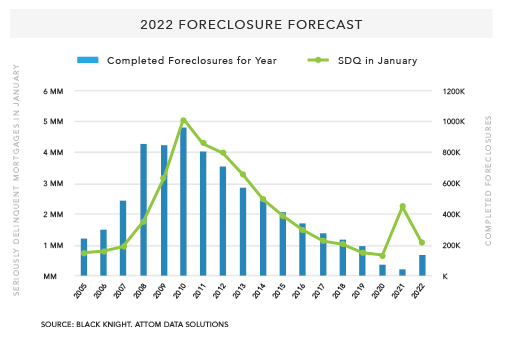

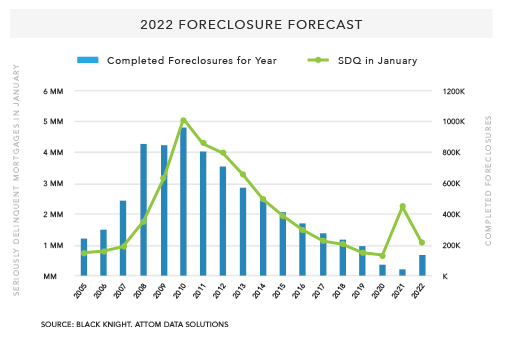

After A Two Year Hiatus Will Foreclosure Volume Return In 2022 Think Realty A Real Estate Of Mind

Owner S Equity Formula Calculator Excel Template

Economic Profit Formula Calculator Examples With Excel Template

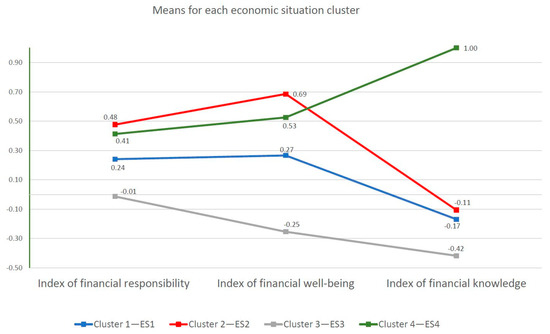

Risks Free Full Text Value Based Financial Risk Prediction Model Html

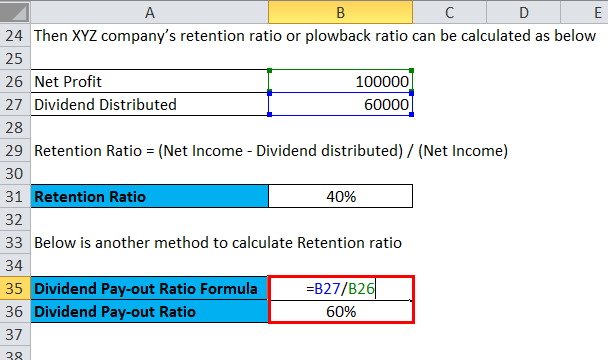

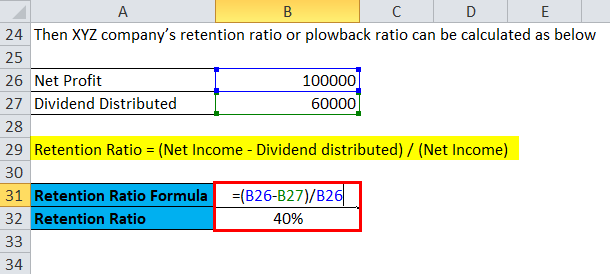

Retention Ratio Formula Calculator Excel Template

Average Collection Period Formula Calculator Excel Template

Retention Ratio Formula Calculator Excel Template

Foreclosure Activity Down 20 Percent First 6 Months Of 2017 Think Realty A Real Estate Of Mind